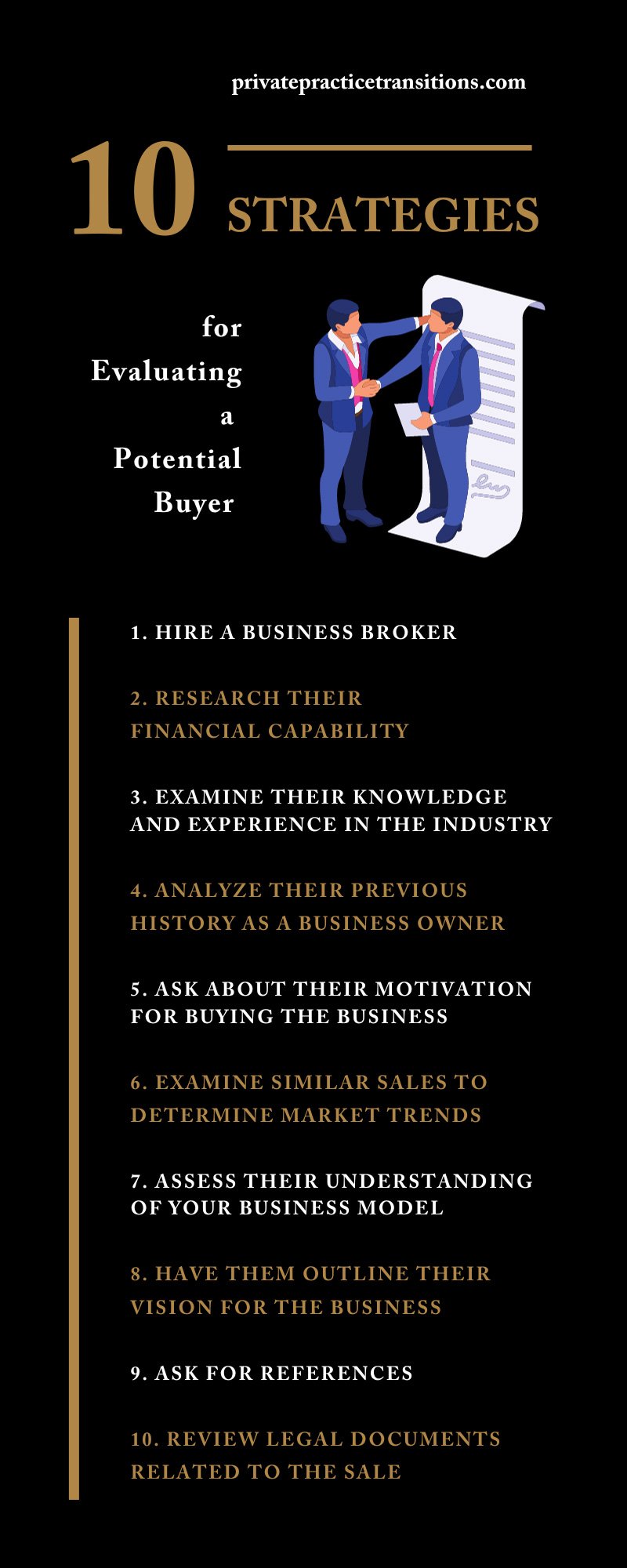

Selling a business is a complex process that requires thoughtful planning and consideration. One of the most important aspects is identifying the right buyer, someone who can maintain and improve the company’s standing and keep it thriving. Below, we’ll outline some key strategies for evaluating a potential buyer to ensure a successful sale and smooth transition for everyone involved.

1. Hire a Business Broker

The first thing you should do is enlist some help with your evaluation by engaging a business broker. Hiring a business broker is an efficient and time-saving method for evaluating potential buyers for your practice. These professionals have the expertise and resources to help you find qualified and serious buyers interested in acquiring your business. They also have a network of contacts who can provide valuable insights and recommendations on potential buyers. Additionally, brokers know how to best negotiate with potential buyers, ensuring you get the best deal for your business.

2. Research Their Financial Capability

Before selling your practice to a potential buyer, you must research their financial capability. This involves gathering information on their current financial standing, including their assets, liabilities, and credit history. A buyer with a strong financial portfolio can provide the necessary funds for the acquisition and have the resources to support and grow the business in the long run. On the other hand, a buyer with financial instability may struggle to keep the business afloat. To avoid future problems, make sure you understand the potential buyer’s finances.

3. Examine Their Knowledge and Experience in the Industry

Evaluating a potential buyer’s knowledge and experience in the industry they’re buying into is crucial in determining their ability to run and grow your business successfully. Look for buyers who have previous experience in the industry, whether your business is in healthcare, accounting, legal services, or other private practice areas. This will ensure they have the necessary skills and knowledge to manage the business effectively and make informed decisions. You don’t want to hand the keys to your pride and joy to someone who knows nothing about the industry. Additionally, consider their experience in managing a business of similar size and operations as your business.

4. Analyze Their Previous History as a Business Owner

Analyzing a potential buyer’s previous history as a business owner can provide valuable insight into their management style and success rate. Look for buyers with experience in running successful businesses and a track record of making sound financial decisions. This will give you confidence that they have the skills and experience to continue growing your practice after you leave. Be sure to also thoroughly research any red flags or issues that may have arisen in their previous business ventures.

5. Ask About Their Motivation for Buying the Business

Understanding the potential buyer’s motivation to acquire your business is essential. Are they looking to expand their current business? Do they have a personal interest in the industry? Are they purely looking for an investment opportunity?

Some buyers may only be curious competitors who are not serious about acquiring the business; instead, they want insider information regarding your practice. Asking questions about motivation will give you a better understanding of their intentions and how seriously they are considering the acquisition. It will also help you determine if their goals align with yours for the future of your business.

6. Examine Similar Sales To Determine Market Trends

Researching previous sales of local businesses in your industry can provide valuable insight into the current market trends. This information can help you determine if the potential buyer’s offer is fair and accurately reflects the current market value of your business. It may also give you a better understanding of what to expect during negotiations and how to navigate them with ease and confidence.

7. Assess Their Understanding of Your Business Model

A potential buyer’s understanding of your business model is essential in evaluating their ability to take over and grow your practice successfully. Ask them specific questions about your operations, services, and policies to gauge their knowledge and familiarity with your business. This will also allow you to identify areas where they may need further education or training before taking over.

8. Have Them Outline Their Vision for the Business

During the evaluation process, ask potential buyers to outline their vision for the future of your business and how they plan to enact this vision. This will give you an idea of their goals and strategies for growing your practice, helping you discern the candidates with good, strong intentions. It will also help you determine if their plans align with yours and if they have a realistic understanding of the industry and your specific business.

9. Ask for References

Before making a final decision, ask potential buyers for references from previous business acquisitions or business partners, if applicable. This will allow you to speak with other business owners who have sold their companies to the same buyer or have simply done business with them. References can also give you an idea of how the potential buyer handles negotiations and if they keep their promises after acquiring businesses. Ultimately, speaking with references can provide a more well-rounded view of the potential buyer and help you make an informed decision.

10. Review Legal Documents Related to the Sale

Finally, consulting a lawyer to review all legal documents related to selling your practice is crucial. This will ensure all necessary agreements and contracts are in place, protecting both parties involved in the acquisition. It is also essential to thoroughly understand any noncompete clauses or other restrictions that may affect your future involvement in the industry. Reviewing these documents with a lawyer can help you avoid any potential legal issues down the line and provide peace of mind during the transaction.

Let Private Practice Transitions Help You Find the Right Buyer

You now know several strategies for evaluating a potential buyer, but much more goes into finding the ideal candidate to take over your business. At Private Practice Transitions, we understand the complexities of selling a business and are committed to helping you find the perfect buyer. We’re experienced in various industries and transactions, from physical therapy practice acquisitions to selling CPA firms and more. We provide essential guidance, connecting you with reputable buyers and helping you navigate the process from start to finish. Let us help you secure a successful sale and a prosperous future for your business!